Gross income calculator yearly

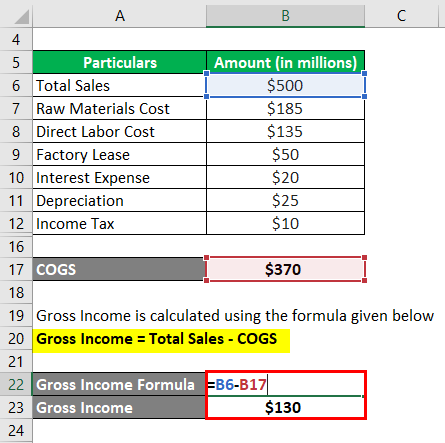

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. Biweekly pay 48 weeks.

Gross Income Formula Calculator Examples With Excel Template

Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year.

. Average annual salary 15 x 15 x 52. If you are paid hourly multiply your hourly. The Income Tax is calculated on the basis of the income tax slab applicable to the taxpayer and the net income.

You can follow the following steps to calculate the income tax for any. Gross income is before tax. The average full-time salaried employee works 40 hours a week.

This adjusted gross income calculator subtracts the deductions from your income to estimate the adjusted gross income which is used to find your total tax liability. There is more info on. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

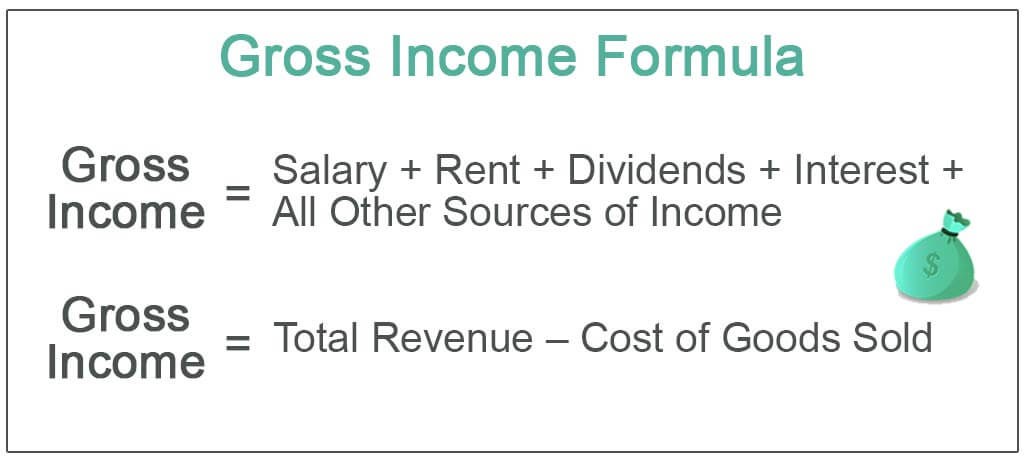

To calculate your average annual salary you would multiply 15 hours a week by 15 dollars an hour. If you make 55000 a year living in the region of New York USA you will be taxed 11959. AGI gross income adjustments to income Gross income the sum of all the money you earn in a.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. You can calculate your AGI for the year using the following formula. Guide to getting paid.

Based on this the average salaried person works 2080 40 x 52 hours a year. That means that your net pay will be 43041 per year or 3587 per month. Our salary calculator indicates that on a 2012570 salary gross income of 2012570 per year you receive take home pay of 1052827 a net wage of.

45000 Salary Calculations example If your salary is 45000 a year youll take home 2851 every month. To determine your hourly wage divide. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income.

Gross pay calculator Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of. Gross annual income - Taxes - CPP - EI Net annual salary Net annual salary Weeks of work per year Net weekly income Net weekly income Hours of work per week Net hourly wage.

Net salary calculator from annual gross income in Ontario 2022. Then multiply that by 52 weeks. The annual income calculation used in this calculator is based on your hourly wage the number of hours that you work per week and the amount of paid time off that you have per.

How to calculate annual income. Youll pay 6486 in tax 4297 in National Insurance and your yearly take-home. This calculator calculates the gross income to net income.

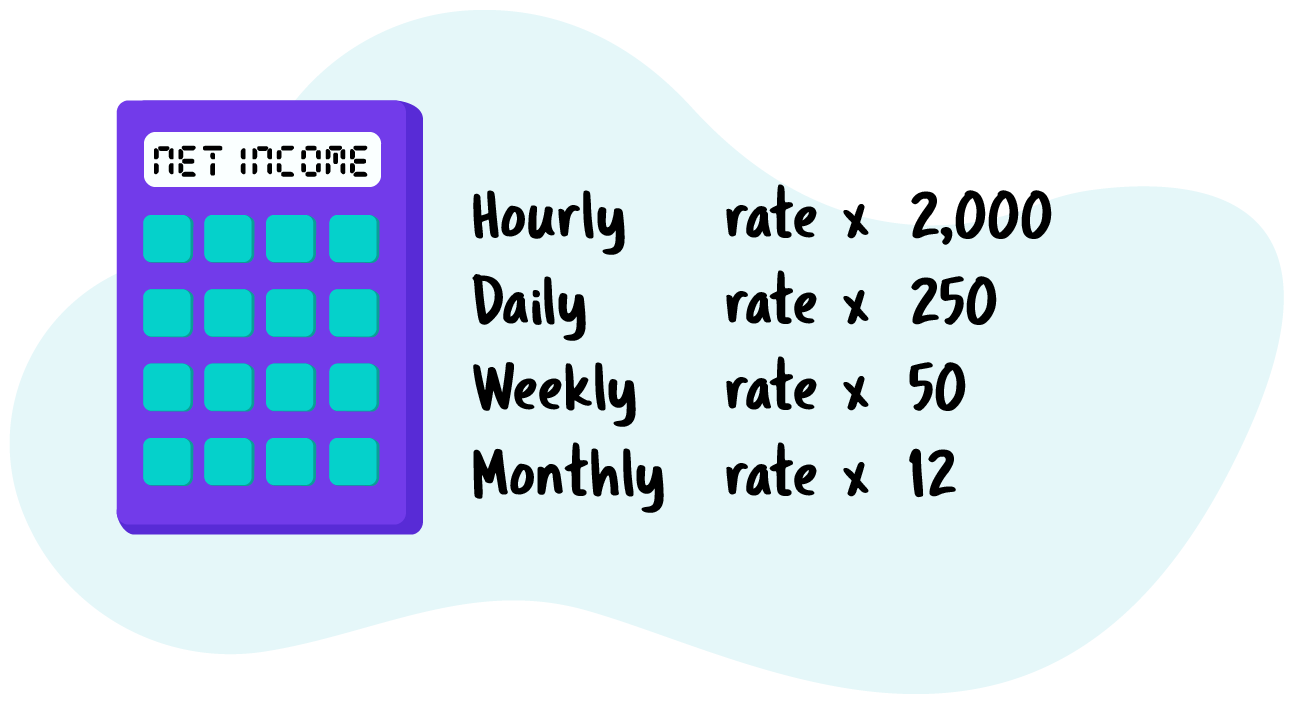

The calculator calculates gross annual income by using the first four fields. The result is net income.

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator Sale Online 50 Off Www Ingeniovirtual Com

Annual Income Calculator Discount 52 Off Www Wtashows Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Annual Income Calculator Discount 52 Off Www Wtashows Com

Annual Income Calculator Discount 52 Off Www Wtashows Com

Yearly Income Calculator Sale 52 Off Www Ingeniovirtual Com

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Income Calculator Online 57 Off Www Ingeniovirtual Com

Annual Income Calculator

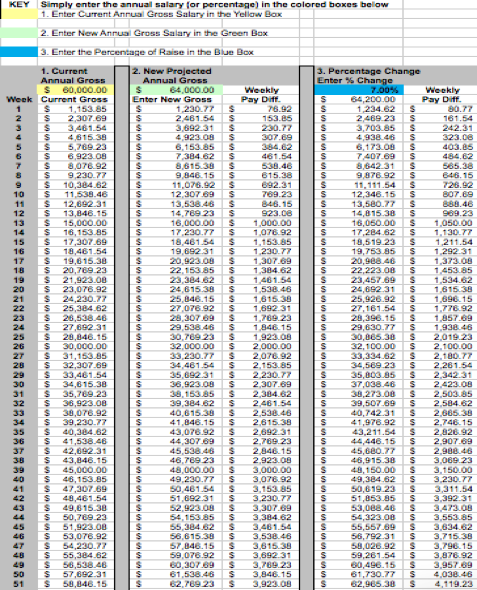

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Annual Income Learn How To Calculate Total Annual Income

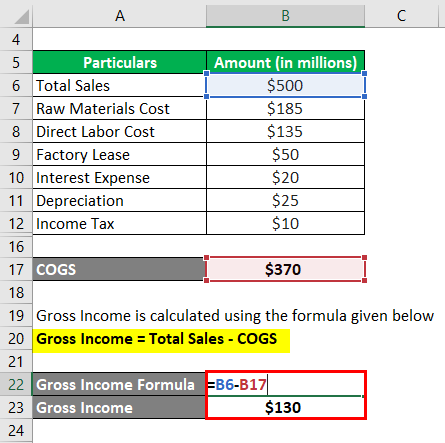

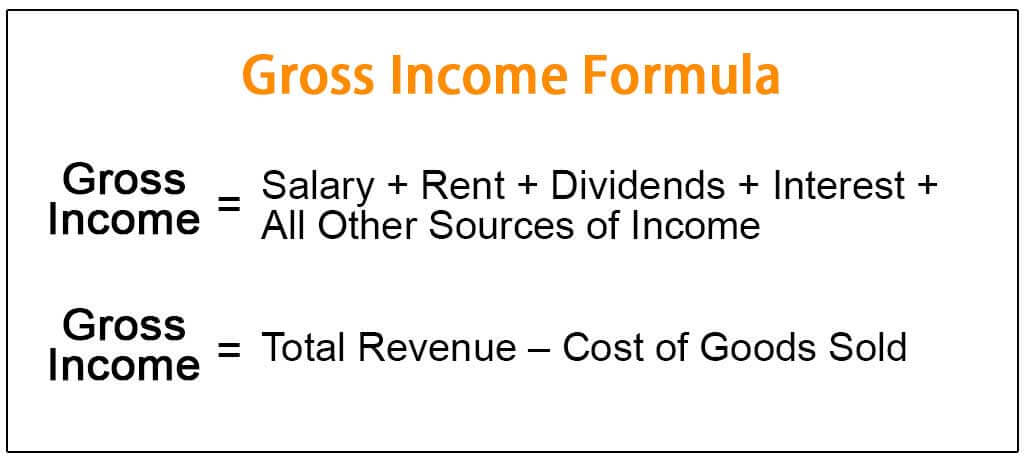

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Calculator Examples With Excel Template

Gross Income Formula Step By Step Calculations